Ever wondered why e-commerce merchants haven’t started setting the prices of their digital products in cryptocurrencies? For instance, setting the price of a shirt at 0.02 BTC.

It’s pretty simple: cryptocurrencies are very volatile. A few hours after the price is determined, the comparable fiat value of 0.02 BTC could vary.

Using Bitcoin or Ethereum to pay may seem like a great idea, but when you try to use it for in-person purchases, things quickly become chaotic because prices fluctuate like a roller coaster.

That is a problem for a merchant attempting to manage cash flow because customers want to know exactly how much they are spending, and businesses need to know how much they are making.

Stablecoins, which are digital currencies pegged to commodities such as the US dollar (USD) or precious metals such as gold, are useful in this situation. They combine the transparency of blockchain with the stability of traditional money.

As crypto payments gain traction, stablecoins are fast becoming the go-to solution for anyone who wants the benefits of crypto — without the chaos. In fact, with our Stablecoin Development Services at Debut Infotech Pvt Ltd, we have been helping modern e-commerce businesses build reliable, scalable digital payment systems for the real world. Below, we discuss the intricate details of how stablecoins in e-commerce reduce the volatility in these digital transactions.

Stablecoin Payments for ECommerce: The Real Game Changer

So, why are stablecoin payments for ecommerce suddenly getting so much attention? Simple — they solve real problems.

Traditional crypto payments were exciting but impractical. Merchants wanted blockchain’s speed and transparency, but not its unpredictability. Stablecoins changed that.

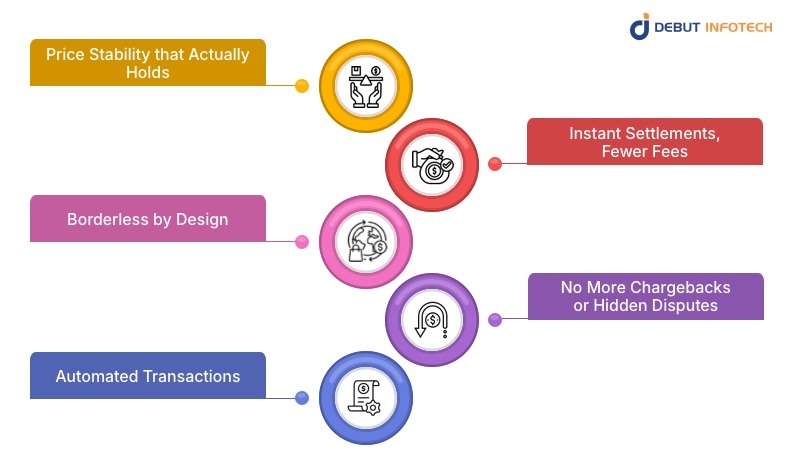

Here’s how they make life easier for online businesses and their customers:

1. Price Stability that Actually Holds

As an e-commerce merchant, you are entitled to receive the exact price you set for a particular commodity. But if you decide to set prices in Bitcoin, that becomes a gamble.

On the other hand, if you use a USD-pegged stablecoin, you get exactly what you expect. No guessing, no last-minute conversions, no losses due to market swings.

It’s stability that finally makes sense in the fast-moving world of e-commerce.

2. Instant Settlements, Fewer Fees

Ever waited two to three business days for payments to clear? With stablecoins, that’s history. Transactions confirm in minutes, sometimes seconds.

And because they’re peer-to-peer on blockchain, you skip banks and middlemen. As a result, you start enjoying lower merchant fees and smoother checkouts for customers.

3. Borderless by Design

Imagine being able to sell a product to a customer on the other side of the globe without worrying about exchange rates, conversion costs, or late payments. Stablecoins make that possible. Whether your customer’s in London, Lagos, or Los Angeles, payments move globally, instantly, and affordably.

4. No More Chargebacks or Hidden Disputes

Every transaction is recorded on blockchain — open, transparent, and irreversible once confirmed. That means fewer chargebacks and almost zero fraud disputes. For e-commerce businesses, that’s huge.

5. Automated Transactions

With the help of stablecoins, merchants can automatically receive instant, final, and irreversible payments from customers worldwide. This is because they run on programmable blockchains that enable merchants to set pre-determined conditions for accepting payments.

When such conditions are met, the merchant doesn’t need to actively request the payment because the smart contracts automatically trigger such collections. Think supplier payments that trigger on delivery confirmation or loyalty rewards sent automatically after a purchase.

It’s a payment infrastructure that actually works for your business.

Real-World Momentum

Stablecoins aren’t just theory anymore — they’re already being used.

For example, Shopify is already joining forces with Coinbase and Stripe to bring frictionless, secure stablecoin payments to merchants around the world through USDC on Shopify payments. Likewise, PayPal launched its own dollar-backed stablecoin, PayPal USD to help its users power their digital transactions, especially in e-commerce settings. Across Asia and Europe, small businesses are quietly switching to stablecoins to speed up and lower the cost of cross-border trade.

That’s not hype; that’s market evolution.

Of course, setting up stablecoin systems — wallets, gateways, compliance layers — takes technical expertise. That’s exactly what stablecoin development companies like Debut Infotech Pvt Ltd help companies do. We build tailored blockchain solutions that make it easy for brands to integrate stablecoin payments without worrying about security or regulation.

Because the truth is, this isn’t a fad. It’s the new payment layer of the internet.

Stablecoin Legislation and Issuers: Trust Is the New Currency

Here’s the thing — for stablecoins to really take off in e-commerce, people need to trust them. The fact that they have numerous obvious benefits doesn’t just mean anyone can just launch their own stablecoin, especially without fulfilling some core requirements.

Essentially, any stablecoin project needs to build trust to thrive, and the two major factors in building trust are credible issuers and clear legislation.

Let’s break these down below:

Who Are Stablecoin Issuers, and Why Do They Matter?

As you might have guessed, the stablecoin issuer is the organisation or entity that either creates or backs any stablecoin that has been created. For example, PayPal issues the PayPal USD.

But the issuers don’t just create the token; they also hold the reserves backing the coin. This could be either cash, U.S. Treasuries, or other assets. They usually maintain these reserves to ensure that each token is truly equivalent to one unit of fiat.

Stablecoin issuers matter in the grand scheme of things because their overall organisation and trustworthiness determine the level of adoption their coin will receive. For instance, when issuers like Circle (USDC) or Tether (USDT) publish transparent audits, users feel confident. Merchants can accept payments knowing that the value behind the coin is legitimate.

Without that transparency? You’d just have another speculative asset, not a stable currency.

The Rise of Stablecoin Legislation

Legislative and regulatory oversight is another vital factor that can influence a stablecoin project’s performance.

You see, in response to growing interest in stablecoins, regulators around the world are paying closer attention to developments in that space, and that’s a good thing.

For example, in the U.S., new bills propose clear guidelines for how stablecoin issuers should manage reserves and redemption rights. Similarly, stablecoins and other crypto assets are subject to new licensing and auditing obligations under the European Union’s MiCA rule. Additionally, nations such as the United Kingdom, Japan, and Singapore are already establishing frameworks to make the use of stablecoins more open and secure.

To put it briefly, stablecoins are emerging from the financial underground and gaining wider acceptance. And if you want potential users to trust your project more, you will need to comply with the relevant stablecoin legislation, depending on your location.

Compliance as a Competitive Edge

Here’s a perspective many businesses miss — regulation isn’t a burden; it’s a trust signal. The companies that get compliance right early on will lead the next wave of crypto-fintech innovation.

Our blockchain teams specialise in building compliance-ready stablecoins that comply with relevant stablecoin legislation. Whether you need fiat-backed token architecture or smart-contract audits for regulatory approval, we build systems that last — not just hype projects that fade.

The Future of Crypto Payments: Stability Is the Real Innovation

We’ve talked about the “crypto revolution” for years, but let’s be honest — it never really hit the mainstream because of one thing: instability.

Now, with stablecoins, that’s changing. They bring predictability to crypto payments, bridging the gap between DeFi and everyday commerce.

So, what’s next?

Cross-Border Trade, Simplified

Stablecoins enable small merchants to sell globally without relying on traditional banking rails. No more delays, no conversion hassles — just fast, frictionless value transfer.

Smart Commerce and Automation

Imagine this: a stablecoin-based checkout that automatically splits payments between your supplier, your logistics partner, and your business account — all in real time. That’s not science fiction; it’s happening already.

Integration with DeFi

Businesses can now plug into decentralised finance systems for instant liquidity or yield on idle reserves. Stablecoins are the gateway into that ecosystem — the safe, predictable bridge.

Tokenised Loyalty and Payments

Think of loyalty points that behave like stablecoins — instantly redeemable, transferable, and trackable on-chain. This is where blockchain starts transforming how brands engage customers.

The bottom line? The use of stablecoin payments for ecommerce is here to stay. More so, it’s not just “crypto 2.0” — it is commerce 2.0.

And for businesses that want to be ready, Debut Infotech, a crypto token development company is already building the rails. From stablecoin issuance to merchant gateway development, we’re helping enterprises tap into blockchain-powered payments safely and strategically.

Conclusion: Stability Is the Bridge to the Future of E-Commerce

At its core, e-commerce is about trust — trust that money will hold its value, that transactions will clear, and that systems will work when needed.

Stablecoins deliver all of that. They take the best of blockchain — speed, transparency, efficiency — and add what’s always been missing: stability.

As stablecoin legislation matures and more trustworthy stablecoin issuers emerge, we’re heading into a phase where crypto payments won’t feel experimental anymore. They’ll just be payments — faster, cheaper, and borderless.

For businesses ready to make that leap, this is your moment. Adopting stablecoin technology today isn’t about chasing a trend—it’s about preparing for the next decade of global commerce.

From cross-border settlements to programmable finance, stablecoins unlock operational agility and financial transparency. If you’re looking to future-proof your infrastructure, now is the time to hire blockchain developers who understand how to build secure, scalable systems tailored for the tokenized economy.

Dive in now, and lead the innovation curve instead of playing catch-up later.